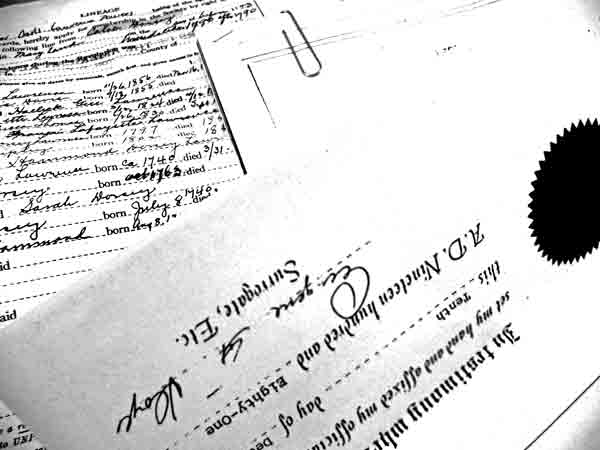

I inherited my first slice of our fading family fortunes at 21. I remember sitting with my father in the sunroom. The rattan furniture was covered in a burnt orange, batik-ish fabric. I was reading a book, he his mail. Then he said something like, “Aha.” Or, “Well.” One of those exclamations that indicate a shift.

He explained that one of his mother’s sisters had died, without heirs. Of the four girls, only two had children. One of them, my father’s mother, had only him. As a result, he would inherit some of his aunt’s estate. But, rather than take possession of the assets, he was going to pass them down to us children, right away.

Generation-skipping, I think it’s called. Favorable tax implications, I think. Generous in any case. So there, unexpectedly, at 21, I had more money in the bank than I could have earned in several years at any job I was likely to find.

The full story of my inheritance, as I have said, is long and full of socioeconomic and gendered landmines. I understand that it’s fairly unique, and do not want to natter on about such a specialized experience.

But there is something more useful than my personal history to be derived. A reader asked me what I thought about kids, and trust funds, and financial resources in their early years out of college. A question to be asked both by those who have always had money, and those who by dint of great talent, or luck, or both, are newly well-to-do. Maybe by everyone with children.

Here’s what my experience tells me, at the highest level.

Finances At The Family Dinner Table

- For all families, discussing money clearly, and revealing the realities in a timely manner, is probably the single most helpful thing a parent can do. More valuable than money itself.

- In trying to get children to understand the value of money we might consider denying kids access to resources all around them in the family. This tends to feels like lack of love and is not recommended.

- The best way to learn about money is to get a job and experience money in and money out. However, forcing kids to work just to “show them what it’s like,” often joins a long list of “dumb things my parents say,” removing all chances of lesson-learning.

- Modeling financial behavior + child’s temperament + all the rest of simply being alive = end result. Money is very intertwined with our emotional foundations of need and response. It’s difficult to teach financial responsibility in a completely dispassionate way.

- As a result, money discussions become all the more important in families with resources. Yes, it is embarrassing to talk about money when you have it, and kids don’t have the context to understand what the numbers really mean. But shame in this context is not useful. A demystified process of financial education should be well underway well before anyone turns 21, or graduates from college.

- These discussions are complex, requiring a sensitivity to what kids are ready for, and when. I imagine this is true for all kinds of families, but would not want to speak, in ignorance, for anyone else.

To Trust Fund Or Not To Trust Fund

- So if you have financial resources, when do you make them available independently to your children? Let us deconstruct.

- Families in a position to set up trust funds will almost certainly have afforded their children a debt-free college education. This is enormously fortunate in and of itself.

- At the end of said education, kids will either have a vision of what they want to do or not. A trust fund will not be useful to someone in the latter situation. In a few cases, those who do know what they want to do could make good use of an infusion of capital, but having to request or qualify for that capital provides a better learning experience than having it in hand.

- A period of survived life uncertainty can be useful, in 2011

- We, in America, are experiencing an inexorable lengthening of youth, as our life expectancies extend. The period of experimentation is longer than it was a few decades ago.

- Even those who take on fully-fledged, traditional adult jobs, may find themselves shifting careers over time. Again, survived uncertainty grounds one.

- Life comes as phases. 21-25 is often quite different than 25-30, and certainly different than 30-35 – if only because women will often want to have children before they reach 35-40

- The vast majority of young people, in the demographic with which I am familiar, will spend the years 21-25 bouncing about

- Those who do not will be gainfully employed, possessed of health insurance, and often saving for a goal. They are apt to calculate future inheritances in, quite rationally, to their plans.

- If you are going to bounce about, you might as well do it broke as rich.

- Turns out that not HAVING to do anything doesn’t solve the problem of what you WANT to do. Or SHOULD do. The greatest cure for anxiety and uncertainty is often a job, a task into which to throw oneself.

At the end of the day, in our early 20’s we all ought to learn what we are capable of, if we don’t know already. Test ourselves. Understand the value of money, not in some moral sense, but transactionally. Understand our own functional worth in the world. Trust funds, excuse the word play, can in fact get in the way of understanding and therefor trusting oneself.

Instead of funding the 21-year old’s portfolio, let that money accumulate until he or she is 25, or even 30. The capital-intensive part of life begins later these days. While it would be disingenuous to say that a chunk of money that allows you to buy a house is a bad thing, the work of one’s early 20’s is perhaps best done on a limited budget.

My professors always brought up the sonnet form when explicating the value of constraints in art. The same applies to life. All of this is as true as I can make it.

38 Responses

Lisa, I just realized that you weren’t a SAHM as a WASP. I mean of course you weren’t and we her know it since we’ve read a lot about business-codes and working experiences. But did you father fully support you with the idea of going back to work? Didn’t he see you at home, with the kids, WASP like? It does not seem to be WASP like at all, working with kids.

now on topic:

That summer, when I was dealing with french fries and oily shoes and floor mops inside a Mc Donald’s at 35°C (age 15), earning a salery that was below the money any unemplyed person receives, my mum knew that I could make it under any circumstances. And she told me so, that she does not ever need to worry if I will make it. Good to know!

You are so right about bouncing about, and that you can just as well do it broke as rich. If my parents had been wealthy, a trust fund that I got at 21 would have gone to travel and grad school (two things I did anyway, with no bad financial repercussions).

But a trust fund that would kick in on my 30th birthday? That’s kids. House. Life.

As always, wise, wise, wise LPC.

In our family, the magic age is 31. As I approach that number, I see the wisdom in that choice. I think because 31 felt so far away when I finished school, I “forget” it’s even there. I’ve established myself without it, and it’ll just be a wonderful ‘gift” when I am able to access it.

Thank you so much, Lisa. This is helpful, to me, to my husband I hope and to my sons. Having started graduate school in my mid-twenties, I totally concur with all you’ve said. Now I have some homework to do in preparation for the ride home from Princeton on Friday. Have you read “What a man knows at 50,” by Adlai Stevenson? If not, here it is:

What a man knows at fifty that he did not know at twenty is, for the most part, incommunicable. The laws, the aphorisms, the generalizations, the universal truths, the parables and the old saws — all of the observations about life which can be communicated handily in ready, verbal packages — are as well known to a man at twenty who has been attentive as to a man at fifty. He has been told them all, he has read them all, and he has probably repeated them all before he graduates from college; but he has not lived them all.

What he knows at fifty that he did not know at twenty boils down to something like this: The knowledge he has acquired with age is not the knowledge of formulas, or forms of words, but of people, places, actions — a knowledge not gained by words but by touch, sight, sound, victories, failures, sleeplessness, devotion, love — the human experiences and emotions of this earth and of oneself and other men; and perhaps, too, a little faith, and a little reverence for things you cannot see.

Address at Princeton University, “The Educated Citizen” (22 March 1954)

Such an interesting post – I agree wholeheartedly with your comments on having an open and frank discussion of money within families. I always had a job, ever since I was 15 or so, and it was one of the most valuable experiences of my life. Nothing teaches you the value of a dollar like earning it doing dishes or waiting tables at a restaurant.

In terms of trust funds – in my experience it’s really dependent on the child – I had access from a young age because my parents wanted me to learn how to invest…but I definitely had other friends who would have blown it all if they got it before 21…but half of those would still blow it all at the age of 35…so what do you do, in that case…?

Thank you so much for writing this post. You were full of honest and blunt points and I think you are correct about 21 being too young. In my family, 21 is too young. In my family, you have to prove yourself to be financially responsible. My Dad almost flunked out of W&L and changed his major from Pre-Law/PoliSci/Business to THEATER. Grandpapa was not pleased and made him pay for his 4th year out of his own pocket – sans inheritance. My aunt had it a little bit easier, but she still inherited late. My Grandpapa has since given us 4 grandchildren “gifts” over the years. I think when an account hits its peak prior to tax penalties, he takes some out and shares it fairly between us 4 grandchildren. When I quit school he did not give me a gift. When I returned to school I was given a gift to prevent my loans from hurting me. He and my grandmama are paying for my wedding. When they both are gone, they plan on giving fiscal gifts to us four grandchildren, and then tangible material possessions split between my Dad and his sister. It keeps the awkward inheritance issues at bay, but I still have a crutch in case something major comes up in my life (health, baby, etc.).

“Turns out that not HAVING to do anything doesn’t solve the problem of what you WANT to do. Or SHOULD do.”

That is a really great point. I didn’t have a trust fund, but in my early 20s was part of a DIY community that valued working as little as possible to have more free time (theoretically to contribute to “the community,” but in practice, not so much).

I’m grateful for that experience, but not sure that time taught me what I WANT to do. Maybe more what I DON’T WANT (um, low-skilled jobs and being broke, for example).

Lisa great words of wisdom and in the following comments as well. n our youth many are not ready to make wise decisions and that is the crux of the matter.

xoxo

Karena

Art by Karena

Come and enter my New Giveaway from Serena & Lily! You will love it!

Great post and I think you make a great point around a debt-free college education. These days that is a wonderful start to adult life. We have saved our own money to make that possible for our three kids, and they are grateful for it. Our son starts University this September (he was just accepted: Honours Physics!)

I hope that if they are left any money by grandparents that it will be at age 30 and definitely not before.

Thank you Lisa for sharing this.

There is a lot of insight here, for those who have money, and those who don’t as well. Some useful things I will pass along to some “Bouncing About” nephews of mine, especially one with a lot of anxiety about the process… thank you!

You’ve so got it right on having financial discussions with one’s kids. We had none with my parents when I was growing up and when I turned 18 I was cut loose to find my way in the world. I had no clue. I had to learn everything from scratch and it was a real challenge. I have often thought that, if I ever had kids, I would make sure they knew how to be financially responsible before they went into the world. That, and how to think critically so they’d be better able to separate the wheat from the chaff in life.

I’d design a trust that would be available in the golden years. It’s easy to earn a living when you’re young, strong and healthy at 30, not so much later on. Having to not worry about my parents financially is a huge blessing.

Thank you for this post. We are currently planing to set up a trust fund for our babies and we were thinking, just as you do, that 30 would be a better age than 21. Neither my husband nor myself come from wealthy families and being from Argentina (myself) and Serbia/Kosovo (my husband) we have been through many financial crisis. We learnt that not having funds does not determine one’s future if one is resilient and is taught how to fight for what one wants. We wouldn’t want that lesson to be lost with our kids because of inheriting money too early.

We were also analyzing the possibility of establishing different funds, for different purposes. We have Italian friends who set up 3 different ones for their daughter:the 1st one can only be used to pay for graduate education, the 2nd one to pay for a house/real estate, the 3rd one for setting up a business/investments. What do you think about something like that?

Hat’s off to one of the best financial reads I have had in a long time. Context is everything.

As usual with you Lisa, there’s enough delicious meat here to gnaw on for a week. For some reason, the word Trust will be my snack for today, probably because the wonderful Stevenson excerpt awakened me to the idea that Trust in human relationships, too, must be carefully explained very young or else, as has played out in my life, the absence of it will be proven by a painful process of elimination. If that makes sense.

Might I encourage you to be working on a book, Lisa?

Hmmm….

I would have, and probably still would, give my right eye to enjoy the security and stability that money, or the promise of money provides.

Had I such in my youth, or earlier youth, I would have had the confidence to study and persue my passions rather than settling for the drudgery I thought necessary to “provide” for a family.

How many great artists or explorers are lost to the practicality and necessity of accounting?

Interesting. My best friend in private school, where I was sent on scraped-up funds as the middle class kid, and where she spent pre-K until high school graduation because one would not want to experience public education, had a trust fund. I recall her getting her frustrated parents’ and trustees’ permission for withdrawals for things like a gumball machine. Seemed silly at the time.

Interesting topic. I have a Revocable Living Trust and one of the beneficiaries is our 14 YO Granddaughter. The rest are adults. I have given some thought to making her portion receivable for College or at a certain age. I hadn’t considered waiting until she is 30 tho. You’ve given me food for thought.

Thanks for your ideas on the subject and for the thoughts of the commentors.

Darla

I’ve been working on my kids to re-think the idea that buying a house is automatically a good idea.

It was a great idea for my husband and I, but I do not think it will automatically be good for people our children’s age.

I think a small windfall at about 21 or graduation-time is nice. Enough so a grad can move someplace they want to go and have a little savings to back them up while they get established. It shouldn’t be so much they don’t have to find something to do.

Great food for thought. Not a trust fund recipient, but have had to make this call for our young adult children. Love the idea that bouncing around is best done with less money. Keeps the soul searching more authentic. We attended an elite college: our peers who were the least purposeful/most lost also seemed to have the most parental resources.

Adolescence is very long in our peer group’s kids… a lot of them can’t add, despite fabulous educations. Our attorney says the 20’s are for firsts (first career, spouse, etc) and making mistakes. He recommends access to inheritances in the 30’s and not all at once. Not all “kids” are the same. It’s hard when you have one who could handle a huge influx at any point without being distracted and another who is less likely to be conservative with it.

Great points and advice. One additional thought is to open a Roth for your child with earned income as a way of investing in the education of their future kids, i.e., your grandchildren, or for your child’s retirement if those funds aren’t needed for education.

Hm. I don’t know if you can bounce about broke as well as rich. I have a shameful amount of envy for the kids I knew who could travel after college for any length of time – I absolutely had to pay my bills, with no backup plan. A trust fund would have been lovely, and knowing I had a place to go if it went bust would have been even better. I think it’s a little off to say that you could go to Spain on absolutely nothing, or maintain self-paid health insurance AND be an upstart artist/musician/what have you.

Then again, we may be talking about different scales of financial support. None vs. Some vs. Want for Nothing?

Hi Julia — I bounced about totally broke. In my early 20s, I didn’t care about having things like health care, new clothes or a decent apartment. (I didn’t have student loans yet either b/c I postponed college for several years.)

Just want to say it’s possible, if you have a VERY simple lifestyle. Not everyone wants that. I don’t even want it now, 10 years later :)

This all seems very logical to me. 21 is rather early, but a nice time to get a bit of one’s pass along. Thirty is when one really can benefit from it, in my experience. Reggie

Couldn’t agree more about bouncing around broke instead of rich. One does need a task to throw oneself into… and being broke (or living your life with only the money you make) makes that all the more real.

Thanks for an insightful post! (As always!)

Great post in the UK still a taboo subject in certain circles,but change is all around.

My Grandfather who had made his fortune himself,taught me how to manage money from an early age,I had a monthly allowance and we would go through the figures each month.

My only child a daughter inherited a trust at 25.

I was a nurse until my G/father died and later decided to run one side of his legacy myself.Ida

My husband and I wrote our wills last year. We have no children and will not have any. His half of the estate would be divided (if we both die at the same time) among his four nieces and nephews, but would be in trust until they are 30 for the very reasons you name: having 20somethings have access to a chunk of cash they did not earn themselves is not a good idea.

This is such an important discussion…and I think there is one element missing. To say that one will be more prepared at 30 than 21 to receive a “windfall” I would agree that the possibility is higher but still no guarantee. I belong to an organization that helps prepare grandchildren, children and adult children for inheritances/trust funds by creating pre-inheritance experiences for them. It is a very fascinating and involved process that includes allowing the benefactors to pass on not only a financial inheritance but other family values and non-monetary assests, as well as family stories and legacies. The process requires family members to learn to communicate, plan, invest, work with advisors, work together and gain all the skills necessary to be prepared to handle much larger sums when the time comes in a test ground pilot program. Family members are made aware that if they can’t learn to work together and learn how to handle money in this kind of test pilot scenario, there will be no inheritance. The process works with 5 years olds as well as 50 year olds. It creates an actual structures spread out over several years that facilitates learning communication, empathy, leadership, charitable giving, investing etc and unites family members across generations and ties them together by helping them build current traditions and connections around valuing each other far beyond money. Over the years as they learn to invest this “pre-inheritance” sum of money they are not allowed to touch the principle but anything they earn on top of the principle can be invested into family projects, vacations, whatever they as a group decide they want to do with it. They are often also given larger sums each year when they return and report, if they have showed earnest effort, and learned the valuable lessons they are being prepared and set up to learn. I bring this up because I find that it offers concrete, in-depth, specific solutions toward everything you stated in the Family Dinner Table section of this article;

# For all families, discussing money clearly, and revealing the realities in a timely manner, is probably the single most helpful thing a parent can do. More valuable than money itself.

# In trying to get children to understand the value of money we might consider denying kids access to resources all around them in the family. This tends to feels like lack of love and is not recommended.

# The best way to learn about money is to get a job and experience money in and money out. However, forcing kids to work just to “show them what it’s like,” often joins a long list of “dumb things my parents say,” removing all chances of lesson-learning.

# Modeling financial behavior + child’s temperament + all the rest of simply being alive = end result. Money is very intertwined with our emotional foundations of need and response. It’s difficult to teach financial responsibility in a completely dispassionate way.

# As a result, money discussions become all the more important in families with resources. Yes, it is embarrassing to talk about money when you have it, and kids don’t have the context to understand what the numbers really mean. But shame in this context is not useful. A demystified process of financial education should be well underway well before anyone turns 21, or graduates from college.

# These discussions are complex, requiring a sensitivity to what kids are ready for, and when. I imagine this is true for all kinds of families, but would not want to speak, in ignorance, for anyone else…

If you or any of your readers would like to know more about this process and how it can be implemented in your own families I would be love to share more. From Shirt Tales to Shirt Tales within Three Generations (and what that actually ends up looking like for each family member involved in it)…the statistics are staggering, the ramifications heartbreaking. Thanks for being willing to open up the conversation…

Paula – This is a complex question. First of all, my father always wanted most of all that I was happy. I am lucky to have a very loving family. That said, our culture has not traditionally been very good at saying things. So there was never any familial discussion of my going back to work. It wasn’t something I wanted to do – it was financially necessary. So with whom would he have had the conversation?:)

Mouse – Thank you. House, kids, life. Exactly.

Princess Freckles – That is just great you’ve been able to “forget” it. I think that’s the best of all possible worlds, and congratulations on having established yourself.

HHH – What a wonderful quotation. I hadn’t read that and it’s so apt. Very glad to have been of use.

Katherine – I should have made a distinction. The issue goes beyond those who would blow the trust at 21. Even those who use the money responsibly are still spending it in the absence of experience, buying knowledge that can be obtained for free. I didn’t blow my trust, just spent money without an understanding of what I wanted or where I was going.

Whitney – Sounds like you have a wise and committed grandfather.

Danielle – Well, knowing that you don’t want low-skilled jobs is some kind of clue, right? But sounds like that community took more than it gave, perhaps.

Karena – Thank you. I agree, the comments are gold.

DaniBP – Wow. It must be such a great feeling to have saved enough to send your kids to college. To say nothing of great modeling for them. Congratulations on your son’s acceptance. I have so much respect for anyone who can even attempt Physics:).

Stephanie – I hope your nephew feels better if he sees this phase as normal, part of life.

Lara in Long Beach – I think what you say is interesting. Often one is taught the mechanics of financial responsibility, but money doesn’t get brought under the light of critical thinking the way other things do.

Patsy – That is a great idea. Of course, that’s what we are all supposed to do in retirement planning;). Not that I have been very good at it.

Marcela – I think 30 is a great idea. I don’t think different funds for different reasons, or incentives, is a good idea. In my way of parenting, I like to set values by example and interaction, not be direct incentive. I never gave money for grades or anything. The only time we ever used direct incentive was when they were little and fighting all the time. We gave them a gold star for every day without a fight, and told them if they went for a month we’d get them a prize. They did it. And then realized that they preferred playing to fighting and have been friends ever since:). But money, in my experience, is like the tax code. Every time you try to tweak behavior too much, you get the opposite reaction.

Laura – Oh, thank you. I am honored.

Flo – Aw. Trust. Painfully learned, worth the effort. And I’m trying to write a damn book proposal but making terribly slow progress. Thanks for the encouragement.

Brohammas – What I have found, in my case, is that I am not prevented from becoming an artist or explorer by the lack of funds. Other forces are the true block, often.

JS – She had one in high school? Curious. I remember wanting a gumball machine though:).

Darla – If you want to fund college, I think that’s different. You can set up a 539 account, with tax advantages, that can only be used for education.

RoseAG – A small windfall might be fine. The cash equivalent of coming home for 3-6 months while they looked for a job. But larger than that and one doesn’t focus on getting established, only on trying to find oneself.

Erin – Wise accountant. And a fine point – even if those who are conservative with money benefit from some time doing without, in my opinion.

Susan – Thank you for the expert advice.

Julia – The envy shouldn’t be shameful. I envy Eric Schmidt, even though I know he must have his issues, even though I read all the research about how lots of money does nothing for one’s happiness. In your scenario, not all of that can be done in one year. But, if you look at the time from 21-27, say, you could take a decent job with health insurance, live cheaply, play music on the side, save money, then go to Spain for a while. And I’m not saying parents shouldn’t help kids out in smaller ways. Health insurance, for example, seems a good one.

Reggie – A bit. Just a bit. Enough for a killer pair of Belgians, right? :).

Any – My pleasure. Tasks are the greatest, I find. Good way to put it.

Ida – I can imagine it’s even less talked about in the UK than here, given the added layer of aristocracy and non-aristocracy. Your grandfather sounds like a wonderful, wise man.

Class Factotum – I always knew you were smart about this kind of stuff.

Rebecca – Thank you for including your services as a resource. My immediate reaction is that for families with very large inheritances, and perhaps parents who have to spend a lot of time on the family business ventures, this would be extremely useful. That said, my next reaction is, for the rest of us shouldn’t this just be parenting, now, in 2011? Maybe I’m too optimistic. If you’d like to continue the conversation, or tell me more about what you offer, I’m happy to discuss and please feel free to email me.

Fascinating post. This world feels a million miles away from my own but you never know what would happen and I think 30 is a much better age than 21. Brilliant idea.

I am very late in commenting on this subject but I have a couple of things to say.

Twenty one is too young for the full trust fund. A series of payments maybe at 21,27 and 31 would be better.

I think that we should encourage our kids to have a gap year. Not like the gap year that wealthy british kids typically have travelling and such, but a real year of actual work. I believe that they would take their college education more seriously if they had prior experience at a job. College would be less of a 5 year party and young adults would learn not only the value of work, but what an actual paycheck looks like after the deductions for taxes, fica, disablitly, etc.

And, wealthy families should read The Buddenbrooks by Thomas Mann and learn the lesson of how the first generation earns it, the second generation uses it and the third generation becomes artists and blows it all.

I’m terribly late to this discussion but I would like to point readers interested in this subject to the work of Barbara Blouin, who has studied, written and lived : ) the subject of inherited wealth and its impact on the receivers.

I think that age 30 is too late to start receiving money. This is not to say that I think it’s a good idea to receive all or even most of the moneys before that age, but rather that it’s a better idea to “ramp up” at younger ages.

One reason I believe this is because many of life’s greatest decisions are taken – by the majority of folk – in the late 20s. Career, spouse, children… All of these important choices are best made when one is not driven primarily by a need to pay one’s bills.

Something that isn’t really touched apon here but which I’ve seen often IRL is the impact that the inheritence has upon the receiver’s spouse/partner. While the inheritor may well have had modelling and discussions re. wealth from his/her own family, the spouse is often thrown into changed financial circumstances with no preparation. And while inheritors often feel a mix of emotions about the inheritance – shame, responsibilty to one’s ancestors who actually earned the money and had the foresight to pass it down, a frantic fear that he/she will be the one who squanders/loses the money and sends the next generation back to shirtsleeves, etc…. – the spouse usually has an entirely different set of reactions.

Comments are closed.